A One Person Company (OPC) is a special company structure under the Companies Act, 2013 that allows a single individual to enjoy the benefits of a private limited company. It was introduced to support solo entrepreneurs, online consultants and small startup founders who want limited liability without adding partners. Unlike a traditional sole proprietorship, an OPC has a separate legal identity, its own PAN and bank account, and clear separation between personal and business assets. OPC registration in India suits freelancers, professionals, e-commerce owners and first-time founders who are serious about growth. In this guide, you will learn what OPC is, the documents required, the registration process, costs, benefits, compliance and when to convert it into a private limited company.

What Is a One Person Company (OPC)?

A One Person Company (OPC) is a private company structure where a single individual acts as both shareholder and director. It is created under the Companies Act, 2013 and has a separate legal identity from its owner. This means the company can own assets, enter into contracts and sue or be sued in its own name. In an OPC, the owner’s liability is limited to the capital invested. One nominee is compulsory, who steps in if the owner dies or becomes incapable, so the business continues without legal gaps or operational disruption. It suits independent professionals, consultants and small startup founders.

Key Features of One Person Company

Single owner structure

One individual owns 100 percent shares and usually acts as director too, making decision making fast and fully controlled by the founder.

Limited liability protection

The owner’s personal assets are protected. Liability is limited to the amount invested in the company.

Separate legal identity

An OPC is registered as a separate legal entity with its own PAN, bank account and legal status, distinct from the owner.

Perpetual succession through a nominee

A nominee is appointed at the time of incorporation so the company can continue if the owner dies or becomes incapable.

Ownership with centralised control

The founder enjoys complete ownership while maintaining corporate structure, branding and better trust in the market.

Lighter compliance than a private limited company

OPC enjoys simpler compliance when compared to a full-fledged private limited company, making it easier for solo founders to manage.

Benefits of Registering an OPC in India

Registering a One Person Company in India gives solo founders the protection and status of a company without handling a complex structure. The biggest benefit is limited liability, where your personal house, savings and family assets stay safe even if the business faces loss or legal issues. An OPC also enjoys stronger credibility than a normal sole proprietorship because clients, vendors and banks see it as a registered company under the Companies Act, 2013.

Banks and NBFCs are more comfortable giving loans and credit facilities to an OPC with proper financial records. Investors and partners also take your brand more seriously when it operates as a company. At the same time, you keep full control over decisions because you are the only shareholder.

OPC registration can also help with tax planning when structured properly with a professional. It suits freelancers, consultants, small agency owners, online business founders and local service providers who want to grow across India. For many first time entrepreneurs, One Person Company registration is a practical midpoint between a simple proprietorship and a full private limited company, giving freedom to scale while staying compliant. Overall, it builds trust, stability and long term business value.

Who Is Eligible to Register an OPC?

Only a natural person who is an Indian citizen and resident in India can register a One Person Company. The promoter can form only one OPC at a time, so you cannot be a member of multiple OPCs. The nominee must also be an Indian resident and should give written consent. The minimum age is 18 years for both the owner and the nominee. Foreign citizens, non-resident Indians and minors are not allowed to incorporate or become members of an OPC.

OPC vs Sole Proprietorship vs Private Limited Company

| Factor | One Person Company (OPC) | Sole Proprietorship | Private Limited Company |

| Legal status | Separate legal entity registered under Companies Act, 2013 | No separate legal entity, owner and business are the same | Separate legal entity with multiple shareholders and directors |

| Liability | Limited to share capital invested | Unlimited, personal assets can be used to pay business debts | Limited to the amount invested in shares |

| Credibility | Higher than proprietorship, good for startups and professionals | Lowest, mainly suitable for very small local businesses | Highest, preferred by banks, investors and corporate clients |

| Compliance | Moderate – lighter than full private limited company | Minimum compliance, very simple but less structured | Higher compliance – more filings, meetings and legal formalities |

| Growth potential | Good for solo founders, can later convert into private limited company | Limited – difficult to raise funds or add partners formally | Very high – easy to add investors, issue shares and expand across India or globally |

Documents Required for One Person Company Registration

To register an OPC, you need basic KYC and office related documents. Keep the following handy: PAN card of owner and nominee, Aadhaar card, latest address proof (electricity bill, bank statement, or telephone bill), passport size photographs, proof of registered office address (rental agreement or sale deed), NOC from the property owner, and written consent plus KYC of the nominee for smooth OPC registration.

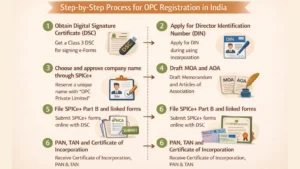

Step-by-Step Process of OPC Registration in India

1. Obtain Digital Signature Certificate (DSC)

The first step is to get a Class 3 DSC for the proposed director. This is used to sign all online forms filed on the MCA portal.

2. Apply for Director Identification Number (DIN)

If you do not have a DIN, it is applied for through the SPICe+ form at the time of incorporation, so you do not need a separate application.

3. Choose and approve company name through SPICe+

Shortlist one or two unique names that match your brand and add “OPC Private Limited” at the end. The name is applied and reserved using the SPICe+ Part A form on the MCA portal.

4. Draft MOA and AOA

Prepare the Memorandum of Association (MOA) and Articles of Association (AOA) which define the main business objects, share capital, rights, duties and internal rules of management for the OPC.

5. File SPICe+ Part B and linked forms

Fill SPICe+ Part B with company, capital, director, nominee and registered office details. Attach all KYC documents, office address proof, nominee consent and required declarations. Sign the forms using DSC and submit them online to the Registrar of Companies.

6. PAN, TAN and Certificate of Incorporation

After verification, the ROC approves the incorporation, PAN and TAN are allotted automatically, and the Certificate of Incorporation is emailed. With this, you can open a current account and start business operations in your OPC name.

OPC Registration Fees and Government Costs

OPC registration costs in India depend on authorised capital, state of registration and professional support. Government fees for filing SPICe+, MOA and AOA are usually modest for small capital companies. You must also budget for Digital Signature Certificate and PAN TAN processing charges. Professional fees for a consultant or CA vary based on service scope. Always ask for a clear breakup of government fees, stamp duty and professional charges to avoid surprise or hidden costs.

Post-Registration Compliance for OPC

After registration, an OPC must file annual financial statements and an annual return with the ROC on time. Income tax returns need to be filed every year, even if turnover is low. Appointment of a statutory auditor is compulsory within the prescribed time. At least one board meeting in each half of the year is required. The company must maintain basic statutory registers and books. Delay or default can lead to penalties and notices from authorities in India.

Conversion of OPC into Private Limited Company

An OPC must be converted into a private limited company once it crosses the prescribed turnover or paid-up capital limits. You can also choose voluntary conversion if you plan to add partners or investors. The process involves passing a board and special resolution, altering the MOA and AOA, increasing the number of directors and shareholders, and filing required forms with the ROC. After conversion, the company gains better funding opportunities and higher growth flexibility.

Common Mistakes to Avoid During OPC Registration

1. Choosing OPC without future planning

Many founders select OPC even when they expect partners or investors soon, when a private limited company may suit long term growth better.

2. Incomplete or unclear documentation

Missing KYC, mismatched name or address details, and no proper NOC from the property owner often cause delays or rejection.

3. Casual nominee selection

Naming a nominee just for formality instead of choosing a responsible person who understands the role can create problems later.

4. Weak or objectionable company name

A name that is too generic, similar to an existing brand, or against MCA rules can get rejected and hurt branding.

5. Ignoring compliance after incorporation

Some owners stop at registration and neglect audit, ROC filing, GST or income tax returns, which leads to penalties and notices.

Need Expert Help with OPC Registration?

Starting a one-person company needs proper documentation and legal accuracy. Suntew makes OPC registration simple and stress-free. From name approval to incorporation and post-registration compliance, their team guides you at every step. Whether you are a freelancer, consultant or startup founder, Suntew helps you register your OPC correctly so you can focus on growing your business.

Visit:https://suntew.biz/

Conclusion

A One Person Company is a smart choice for solo entrepreneurs who want the protection and structure of a company without giving up control. When registered correctly, an OPC helps you separate personal and business risk, build stronger credibility and plan for long term growth. It is especially powerful for consultants, freelancers, agency owners and small startups who are ready to formalise their business. At the same time, legal procedures, documentation and compliance can feel confusing if you try to do everything alone. Taking professional help ensures your OPC is set up properly from day one, so you avoid penalties later and stay focused on serving clients, winning projects and steadily expanding your brand across India with clarity and confidence.

FAQs

1. What is a One Person Company (OPC) in India?

An OPC is a private company structure where one individual owns all the shares, enjoys limited liability and runs a business that has a separate legal identity under the Companies Act, 2013.

2. Who is eligible to register a One Person Company?

Any Indian citizen who is resident in India can form an OPC, if aged 18 or above, with only one OPC in their name and an eligible nominee in place.

3. What documents are required for OPC registration in India?

You need PAN and Aadhaar, a recent address proof, passport size photo, proof of registered office address, NOC from the owner if rented and full KYC plus consent of the nominee.

4. How much time does it take to register a One Person Company?

Typically, once documents are ready, OPC registration takes about 7 to 10 working days, depending on name approval and MCA processing speed in your jurisdiction.

5. Can an OPC be converted into a Private Limited Company later?

Yes, an OPC can later be converted into a private limited company by adding members and directors and filing the prescribed conversion forms with the Registrar of Companies.